UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the registrant þ Filed by a party other than the registrant o

Check the appropriate box:

|

| |

| o | Preliminary Proxy Statement |

|

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

| þ | Definitive Proxy Statement |

|

| |

| o | Definitive Additional Materials |

|

| |

| o | Soliciting Material Pursuant to §240. 14a-12 |

Ensco plc

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

|

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

|

| |

| o | Fee paid previously with preliminary materials. |

|

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

|

| | |

| | Ensco plc 6 Chesterfield Gardens London, W1J 5BQ Phone: +44 (0) 20 7659 4660 www.enscoplc.com Company No. 7023598 |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on 2120 May 20182019

The Annual General Meeting of Shareholders of Ensco plc ("Ensco," "we," "us," "our" or the "Company") will be held at the Serpentine Suite of the London Hilton on Park Lane, 22 Park Lane, London, W1K 1BE, United Kingdom, at 8:00 a.m. London time, on Monday 2120 May 20182019 (the "Meeting").

You will be asked to consider and to pass the resolutions below. Resolutions 11 and 12 will be proposed as special resolutions. All other resolutions will be proposed as ordinary resolutions.

ORDINARY RESOLUTIONS

| |

| 1. | To re-elect, by way of separate ordinary resolutions, the eleven Directorssix directors named in the section headed "Resolution 1" of the accompanying proxy statement to serve until the 20192020 Annual General Meeting of Shareholders. |

| |

| 2. | Conditional on the Company not having completed, before the Meeting, the acquisition of the entire issued and to be issued Class A ordinary share capital of Rowan Companies plc ("Rowan"), pursuant to the Transaction Agreement, dated as of October 7, 2018, entered into between the Company and Rowan (as amended and as may be further amended from time to time (the "Transaction Agreement", and such acquisition referred to herein as the "Rowan Transaction"), to re-elect, by way of separate ordinary resolutions, the five directors named in the section headed "Resolution 2" of the accompanying proxy statement to serve until the 2020 Annual General Meeting of Shareholders. |

| |

| 3. | Conditional on the Company having completed the Rowan Transaction before the Meeting, to elect, by way of separate ordinary resolutions, the five directors named in the section headed "Resolution 3" of the accompanying proxy statement to serve until the 2020 Annual General Meeting of Shareholders. |

| |

| 4. | To ratify the Audit Committee's appointment of KPMG LLP (U.S.) as our U.S. independent registered public accounting firm for the year ending 31 December 2018.2019. |

| |

3.5. | To appoint KPMG LLP (U.K.) as our U.K. statutory auditors under the U.K. Companies Act 2006 (to hold office from the conclusion of the Meeting until the conclusion of the next Annual General Meeting of Shareholders at which accounts are laid before the Company). |

| |

4.6. | To authorise the Audit Committee to determine our U.K. statutory auditors' remuneration. |

| |

5. | To approve the Ensco plc 2018 Long-Term Incentive Plan. |

| |

6.7. | To cast a non-binding advisory vote to approve the Directors' Remuneration Report for the year ended 31 December 20172018 (excluding the Directors' Remuneration Policy). |

| |

7.8. | To cast a non-binding advisory vote to approve the compensation of our named executive officers. |

| |

8.9. | To cast a non-binding advisory vote to approve the reports of the auditors and the directors and the U.K. statutory accounts for the year ended 31 December 2017. |

| |

9. | To (i) approve the terms of the proposed purchase agreement or agreements providing for the purchase by the Company of up to 65.0 million shares for up to a maximum of $500.0 million in aggregate from one or more financial intermediaries and (ii) authorise the Company to make off-market purchases of shares pursuant to such agreement or agreements, the full text of which can be found in "Resolution 9" of the accompanying proxy statement. The authority conferred by "Resolution 9" will, unless varied, revoked or renewed by the shareholders prior to such time, expire five years after the date of the passing of this resolution.2018. |

| |

| 10. | To authorise the Board of Directors to allot shares, the full text of which can be found in "Resolution 10" of the accompanying proxy statement. |

SPECIAL RESOLUTIONS

| |

| 11. | To approve the general disapplication of pre-emption rights, the full text of which can be found in "Resolution 11" of the accompanying proxy statement. |

| |

| 12. | To approve the disapplication of pre-emption rights in connection with an acquisition or specified capital investment, the full text of which can be found in "Resolution 12" of the accompanying proxy statement. |

Resolutions 1 through 10 will be proposed as ordinary resolutions, which means, assuming a quorum is present, each of Resolutions 1 through 10 will be approved if a simple majority of the votes cast are cast in favour thereof. Resolutions 11 and 12 will be proposed as special resolutions, which means, assuming a quorum is present, each of Resolutions 11 and 12 will be approved if at least 75% of the votes cast are cast in favour thereof.

With respect to the non-binding, advisory votes on Resolutions 6, 7, 8 and 8,9, regarding (respectively) the Directors' Remuneration Report, the compensation of our named executive officers, and the U.K. statutory reports and accounts, the result of the vote will not require the Board of Directors or any committee thereof to take any action. However, our Board of Directors values the opinions of our shareholders as expressed through their advisory votes on such non-binding resolutions and other communications. Accordingly, the Board of Directors will carefully consider the outcome of the advisory votes on Resolutions 6, 7, 8 and 8.9.

Please review the proxy statement accompanying this notice for more complete information regarding the Meeting and the full text of the resolutions to be proposed at the Meeting.

By Order of the Board of Directors,

Michael T. McGuinty

Senior Vice President, General Counsel and Secretary

3029 March 20182019

YOUR VOTE IS IMPORTANT. FOR SPECIFIC INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS INCLUDED WITH THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR THE PROXY CARD INCLUDED WITH THE PROXY MATERIALS.

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting. For more complete information regarding our 20172018 fiscal performance, please review our annual report on Form 10-K for the period ended 31 December 2017.2018. This proxy statement, our 20172018 annual report and a proxy card are first being sent or distributed to shareholders on or about 98 April 2018.2019.

20182019 Annual General Meeting of Shareholders

Time and Date: 8:00 a.m. London time

Place: Serpentine Suite of the London Hilton on Park Lane, 22 Park Lane, London,

W1K 1BE, United Kingdom

Meeting Date: 2120 May 20182019

Record Date: 2625 March 20182019

Voting Cutoff Date: 3:00 p.m. Eastern Time on 1817 May 20182019

11:59 p.m. Eastern Time on 1514 May 20182019 for shares held in the Ensco Savings Plan

Voting Matters and Board Recommendations

|

| |

| Re-election and election of Directors (resolutions 1-3) | FOR each Nominee |

| Ratify KPMG LLP (U.S.) as U.S. Independent Auditors | FOR |

| Appoint KPMG LLP (U.K.) as U.K. Statutory Auditors | FOR |

| Authorise the U.K. Statutory Auditors' Remuneration | FOR |

Approve the Ensco plc 2018 Long-Term Incentive Plan | FOR |

| Advisory Vote to Approve the Directors' Remuneration Report | FOR |

| Advisory Vote to Approve Named Executive Officer Compensation | FOR |

| Advisory Vote to Approve the U.K. Statutory Accounts | FOR |

Authorise Share Repurchase Program | FOR |

| Authorise the Board of Directors to Allot Shares | FOR |

| Special Resolution to Approve the General Disapplication of Pre-emption Rights | FOR |

| Special Resolution to Approve the Disapplication of Pre-emption Rights in connection with an acquisition or specified capital investment | FOR |

Board Nominees

| | | Name | Name | Age | Director Since | Principal Occupation | Committees | Independent (Yes/No) | Age | Director Since | Principal Occupation | Independent (Yes/No) |

| | | | |

| J. Roderick Clark | J. Roderick Clark | 67 | 2008 | Former President and Chief Operating Officer of Baker Hughes Incorporated (Retired) | Compensation | Yes | 68 | 2008 | Former President and Chief Operating Officer of Baker Hughes Incorporated (Retired) | Yes |

| Roxanne J. Decyk | 65 | 2013 | Former Executive Vice President of Global Government Relations for Royal Dutch Shell plc (Retired) | Compensation | Yes | |

| Mary E. Francis CBE | Mary E. Francis CBE | 69 | 2013 | Former Senior Civil Servant in British Treasury and Prime Minister's Office (Retired) | Audit; Nominating and Governance | Yes | 70 | 2013 | Former Senior Civil Servant in British Treasury and Prime Minister's Office (Retired) | Yes |

| C. Christopher Gaut | C. Christopher Gaut | 61 | 2008 | Chairman of Forum Energy Technologies, Inc. | Nominating and Governance | Yes | 62 | 2008 | President and Chief Executive Officer and Chairman of Forum Energy Technologies, Inc. | Yes |

| Keith O. Rattie | | 65 | 2008 | Former Chairman, President and Chief Executive Officer of Questar Corporation and Former Chairman of QEP Resources (Retired) | Yes |

| Paul E. Rowsey, III | | 64 | 2000 | Former Chief Executive Officer of Compatriot Capital, Inc. (Retired) | Yes |

| Carl G. Trowell | | 50 | 2014 | President and Chief Executive Officer of Ensco plc | No |

| | | |

Nominees conditioned on not completing the Rowan Transaction before the Meeting: | | Nominees conditioned on not completing the Rowan Transaction before the Meeting: |

| Name | | Age | Director Since | Principal Occupation | Independent (Yes/No) |

| | | |

| Roxanne J. Decyk | | 66 | 2013 | Former Executive Vice President of Global Government Relations for Royal Dutch Shell | Yes |

| Jack E. Golden | Jack E. Golden | 69 | 2017 | Managing Partner of Edgewater Energy LLC | | Yes | 70 | 2017 | Managing Partner of Edgewater Energy LLC | Yes |

| Gerald W. Haddock | Gerald W. Haddock | 70 | 1986 | President and Founder of Haddock Enterprises, LLC | Audit; Nominating and Governance | Yes | 71 | 1986 | President and Founder of Haddock Enterprises, LLC | Yes |

| Francis S. Kalman | Francis S. Kalman | 70 | 2011 | Former Executive Vice President of McDermott International, Inc. (Retired) | Audit; Compensation | Yes | 71 | 2011 | Former Executive Vice President of McDermott International, Inc. (Retired) | Yes |

| Keith O. Rattie | 64 | 2008 | Former Chairman, President and Chief Executive Officer of Questar Corporation and Former Chairman of QEP Resources (Retired) | Audit | Yes | |

| Paul E. Rowsey, III | 63 | 2000 | Former Chief Executive Officer of Compatriot Capital, Inc. (Retired) | Nominating and Governance | Yes | |

| Carl G. Trowell | 49 | 2014 | President and Chief Executive Officer of Ensco plc | | No | |

| Phil D. Wedemeyer | Phil D. Wedemeyer | 68 | 2017 | Former Partner of Grant Thornton LLP (Retired) | | Yes | 69 | 2017 | Former Partner of Grant Thornton LLP (Retired) | Yes |

| | | |

Nominees conditioned on completion of the Rowan Transaction before the Meeting: | | Nominees conditioned on completion of the Rowan Transaction before the Meeting: |

| Name | | Age | Director Since | Principal Occupation | Independent (Yes/No) |

| | | |

| Dr. Thomas Burke | | 51 | N/A | President and Chief Executive Officer of Rowan Companies plc | No |

| William E. Albrecht | | 67 | N/A | Non-Executive Chairman of the Board of California Resources Corporation | Yes |

| Suzanne P. Nimocks | | 60 | N/A | Senior Partner of McKinsey & Company (Retired) | Yes |

| Thierry Pilenko | | 61 | N/A | Executive Chairman of TechnipFMC plc | Yes |

| Charles L. Szews | | 62 | N/A | Chief Executive Officer of Oshkosh Corporation (Retired) | Yes |

2017

2018 Business Overview

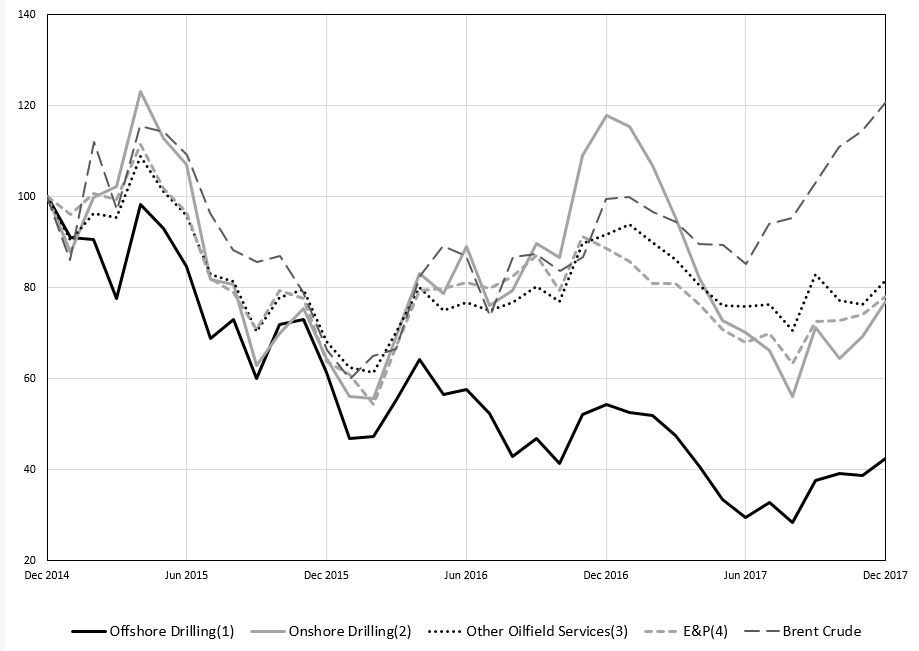

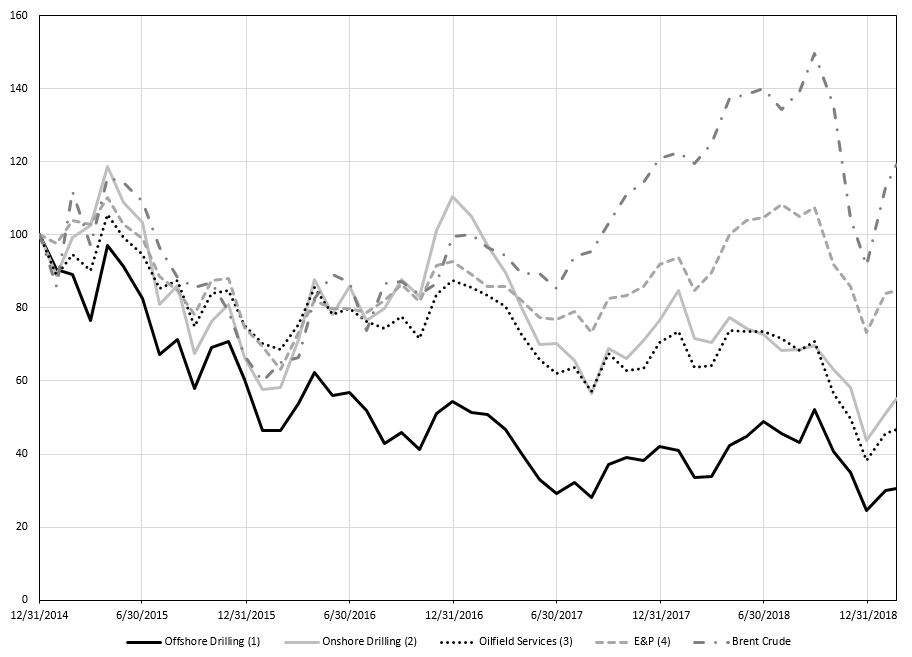

During 2017,2018, Ensco and its peers in the offshore drilling industry continued to face headwinds from an unprecedenteda deep and abiding industry downturn. Depressed oildownturn caused by low commodity prices as comparedthat made many projects uneconomic for customers. Through this downturn, which has led to 2014 highs have caused:

Significant declinedeclines in customer capital expenditures, declines in the demand for offshore drilling services as many of our customers' projects became uneconomical;

Substantial reduction to customer capital expenditures for offshore projects and cancelled or deferred existing drilling programs, resulting in drilling contract cancellations, fewer market tenders and scarce new drilling contracts; and

Oversupply of rigs, which combined with the above, has resulted in significantly reduced day rates and utilisation across the offshore drilling sector.

Onshore drillers experienced better stock price performance due to improved commodity prices during 2017, but the offshore drilling sector continues to lag. Commodity prices have not improved enough to support the offshore activity levels needed to absorb the existingan oversupply of rigs, resulting in continued pressurewe have remained focused on offshore day rates.

Recent contract awards have demonstrated a customer preference for high-specification rigs contracted with established well-capitalised offshore drilling companies. As a result, we are positioning ourselves to capitalise on the eventual recovery by:as it eventually unfolds, for the long term benefit of our shareholders. In particular, we are:

Taking the lead on industry consolidation, following up on our 2017 acquisition of Atwood Oceanics, Inc. (“Atwood”), we reached an agreement to combine with Rowan Companies plc (“Rowan”), which was approved by our shareholders and Rowan’s shareholders in February 2019;

Maintaining a diversified and versatile fleet of high-quality rig fleet;assets capable of meeting customer demand in deep- and shallow-water globally;

Continuing our track record of safety and operational excellence, which included outperforming an industry wide safety metric by 30% and full year fleet-wide operational utilisation of 98% (operational utilisation represents the percentage of day rate earned for contracted days excluding days for planned downtime and mobilisation);

Focusing on technologywinning new contracts as customer activity has begun to increase in certain market segments. In 2018 we added more than $900 million of contracted revenue backlog;

Investing in innovations to differentiate ourselves through proprietary technologies and innovation;unique capabilities; and

Expanding our global footprint; and

Strengthening ourMaintaining a strong financial position.position with manageable debt maturities.

During 2017,2018, we continued to improve our capital management flexibility, enhance our fleet reduce expenses and invest in initiatives that will enhancebenefit our operational and safety performance. Our emphasis on operational excellence, sustainable cost control, management systems,innovation, capital management, and liquidity, human capital, service efficiency and strategic execution led to strong operational results for the year. For further details about our 2017 operational and financial achievements, see "Compensation Discussion and Analysis- Executive Summary - 2017 Business Achievements."

Executive Compensation Philosophy

Our executive compensation philosophy is based on the principle that the creation of long term shareholder value is the most important measure of executive officer performance. The business objectives against which we measure our performance include:

financial performance;

creation of and preservation of a strong balance sheet;

industry leading safety performance;

operational efficiency;

customer satisfaction;

positioning assets in markets that offer prospects for long-term growth in profitability; and

strategic and opportunistic enhancement of our rig fleet.

We believe that achievement of these business objectives will contribute todrive growth in shareholder value over time. We stress the importance of these objectives throughAccordingly, we align the structure of our executive compensation program by placing the majority of executive pay at risk and subjecting a significant portion of each executive officer'sNEO's potential compensation to specific annual and long-term performance requirements.requirements and TSR.

Share Repurchase Program

As a U.K. Company, we are governed by the U.K. Companies Act 2006 (the "Companies Act"). Under the Companies Act, the Company is only permitted to undertake "off-market" share repurchases (meaning that any share repurchases must be effected by way of a purchase agreement rather than on a stock exchange), as our Class A ordinary shares ("shares") are only listed on the NYSE which is not a recognised investment exchange for U.K. purposes. The Companies Act also requires that the terms of any off-market purchase contract must be approved by our shareholders before the Company may undertake share purchases pursuant to such agreement. The Board of Directors (the "Board" or the "Directors") has authorised the repurchase of up to 65.0 million of our shares for up to a maximum of $500.0 million in aggregate (subject to shareholder approval) and our proposed Resolution 9 would give the Directors the power to implement such share repurchase program in accordance with U.K. law. The share repurchase program would give us added flexibility to return capital to shareholders over the coming years in the event investment opportunities do not meet our return criteria. The Board confirms that the authority to purchase shares under the share repurchase program will only be exercised after careful consideration of prevailing financial market conditions, the overall position of the Company and other potential uses of free cash flow, including investment in our fleet and dividend increases. The share repurchase program, if approved, will be valid for up to five years and may be discontinued by the Board at any time. Any Class A ordinary shares purchased pursuant to the share repurchase program will be cancelled. The share repurchase program will replace the share repurchase program that was approved by shareholders at the 2013 annual general meeting of shareholders and which will expire prior to the Meeting.

Allotment of Shares

Under the Companies Act, we cannot issue new shares (other than in certain limited circumstances) without first obtaining approval from our shareholders. The Companies Act provides that this approval grants authority to the Board to allot shares in the Company and to grant rights to subscribe for or convert any security of the Company into shares of the Company. Without the grant of authority from shareholders described in Resolution 10, the Board would be unable to issue any new shares without obtaining specific prior approval from our shareholders. Prior shareholder authorisation for the issue of new shares is required as a matter of U.K. law and it is customary for public limited companies incorporated under the laws of England and Wales to seek a general authority to issue new shares on an annual basis.

Disapplication of Pre-emption Rights

Under the Companies Act, our shareholders have pre-emption rights to subscribe for any ordinary shares we issue for cash in proportion to their existing shareholdings, which means we must offer shareholders the right to purchase any shares we intend to issue for cash. Our proposed Resolutions 11 and 12 would give the Directors the power to issue ordinary shares (or sell any ordinary shares which the Company elects to hold in treasury) for cash without first offering them to existing shareholders. Approval of these Resolutions would provide the Directors with flexibility to pursue strategic transactions, raise capital and finance growth with equity. Prior shareholder authorisation for the issue of new shares for cash on a non-pre-emptive basis is required as a matter of U.K. law and it is customary for public limited companies incorporated under the laws of England and Wales to seek a general authority to disapply pre-emption rights and an authority to disapply pre-emption rights in connection with an acquisition or specified capital investment on an annual basis.

QUESTIONS AND ANSWERS ABOUT

THE MEETING AND VOTING

1. What is a proxy statement and what is a proxy?

A proxy statement is a document that the U.S. Securities and Exchange Commission ("SEC") regulations require us to give you when we ask you to sign a proxy designating individuals to vote on your behalf. A proxy is your legal designation of another person to vote the shares you own. The person designated is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. We have designated two of our officers as proxies for the Meeting, Carl G. Trowell and Michael T. McGuinty.

2. Why did I receive these proxy materials?

We are providing this meeting notice, proxy statement, proxy card and 20172018 annual report and U.K. statutory accounts (the "proxy materials") in connection with the solicitation by our Board of proxies to be voted at our Meeting. The proxies also may be voted at any continuations, adjournments or postponements of the Meeting. This proxy statement contains information you may use when deciding how to vote in connection with the Meeting. All shareholders as of the close of business on 2625 March 20182019 are entitled to receive notice of, attend and vote at the Meeting or, subject to our Articles of Association, any adjournment or postponement of the Meeting. A list of all shareholders of record entitled to vote at the Meeting is on file at our principal executive offices, 6 Chesterfield Gardens, 3rd Floor, London, W1J 5BQ, United Kingdom, and will be available for inspection at the Meeting. Changes to entries on the register after this time will be disregarded in determining the rights of any person to attend or vote at the Meeting.

3. Why did I receive a Notice of Internet Availability of Proxy Materials instead of printed proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our shareholders. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. We encourage you to take advantage of the availability of the proxy materials on the Internet in order to help reduce the costs and environmental impact of the Meeting.

4. Why did I not receive the Notice by mail or e-mail?

If you elected to receive proxy materials by mail or e-mail for any of your holdings in the past, you were automatically enrolled using the same process for all your holdings this year. If you would like to change the method of delivery, please follow the instructions set forth in the answer to Question 7.

5. How can I access the proxy materials over the Internet?

Pursuant to rules adopted by the SEC, we provide shareholders access to our proxy materials for the Meeting over the Internet. The proxy materials for the Meeting are available at www.proxyvote.com. To access these materials and to vote, follow the instructions shown on the proxy card, voting instruction card from your broker or the Notice.

6. Can I get paper copies of the proxy materials?

You may request paper copies of the proxy materials, including our 20172018 annual report and U.K. statutory accounts, by calling 1-800-579-1639 or e-mailing sendmaterial@proxyvote.com. You also may request paper copies when prompted at www.proxyvote.com.

7. Can I choose the method in which I receive future proxy materials?

There are three methods in which shareholders of record and beneficial owners may receive future proxy materials or notice thereof:

Notice and Access: The Company furnishes proxy materials over the Internet and mails the Notice to most shareholders.

E-mail: If you would like to have earlier access to future proxy materials and reduce our costs of printing and delivering the proxy materials, you can instruct us to send all future proxy materials to you via e-mail. If you request future proxy materials via e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials via e-mail will remain in effect until you change it. If you wish to receive all future materials electronically, please visit www.investordelivery.com to enroll or, if voting electronically at www.proxyvote.com, follow the instructions to enroll for electronic delivery after you vote.

Mail: You may request distribution of paper copies of future proxy materials by mail by calling 1-800-579-1639 or e-mailing sendmaterial@proxyvote.com. If you are voting electronically at www.proxyvote.com, follow the instructions to enroll for paper copies by mail after you vote.

If you are a beneficial owner, you should consult the directions provided by your broker, bank, trust or other nominee with respect to how you receive your proxy materials and how to vote your shares.

If there are multiple shareholders residing at the same address, we will send one set of proxy materials per household. However, you may inform us as to whether you wish to receive one set of proxy materials per household or one set of proxy materials per person in the future by calling or emailing as set forth above.

8. Can I vote my shares by completing and returning the Notice?

No, the Notice simply instructs you on how to vote.

9. When and where is the Meeting and who may attend?

The Meeting will be held on 2120 May 20182019 at 8:00 a.m. London time at the Serpentine Suite of the London Hilton on Park Lane, 22 Park Lane, London, W1K 1BE, United Kingdom. All Ensco shareholders of record and beneficial owners as of the close of business on 2625 March 20182019 may attend the Meeting.

10. What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered in your name on the books and records of Computershare Trust Company, N.A., our transfer agent, you are a "shareholder of record." Accordingly, we sent the Notice directly to you.

If your shares are held for you in the name of your broker, bank, trust or other nominee as custodian, your shares are held in "street name," and you are considered the "beneficial owner." Either the Notice or the proxy materials have been forwarded to you by your broker, bank, trust or other holder of record, who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank, trust or other nominee on how to vote your shares by using the voting instruction card included in the mailing.

11. How do I attend the Meeting? What do I need to bring?

Shareholders of Record: If you are a shareholder of record at the close of business on 2625 March 20182019 and plan to attend the Meeting, please bring the Notice to the Meeting as your proof of ownership of Ensco shares.

Beneficial Owners: If you are a beneficial owner and plan to attend the Meeting, you will need to bring evidence of your ownership of Ensco shares as of 2625 March 20182019 in the form of a recently dated letter from your broker, bank, trust or other nominee and a photo ID as proof of your identity. If you wish to vote at the Meeting, you must also bring a legal proxy as described in the answer to Question 17.

Note to All Meeting Attendees: Please note that no cameras, recording equipment, laptops, tablets, cellular telephones, smartphones or other similar equipment, electronic devices, large bags, briefcases or packages will be permitted in the Meeting, and security measures will be in effect to ensure the safety of attendees. In all cases, you will need a photo ID to gain admission.

12. What are my voting choices for each of the resolutions to be voted on at the Meeting?

You may vote "for" or "against" or you may elect to "abstain" with respect to each resolution. We have majority voting for the election of directors. Under our Articles of Association, when a quorum is present, a nominee seeking election to a directorship shall be elected if a majority of the votes cast are cast in favour of the resolution to elect or re-elect the director.

Resolutions 1 through 10 will be proposed as ordinary resolutions, which means, assuming a quorum is present, each of Resolutions 1 through 10 will be approved if a majority of the votes cast are cast in favour thereof. Resolutions 11 and 12 will be proposed as special resolutions, which means, assuming a quorum is present, each of Resolutions 11 and 12 will be approved if at least 75% of the votes cast are cast in favour thereof. With respect to the non-binding advisory votes on Resolutions 6, 7, 8 and 8,9, the result of the vote will not require our Board or any committee thereof to take any action. However, our Board values the opinions of our shareholders as expressed through their advisory votes on such non-binding resolutions and other communications. Accordingly, our Board will carefully consider the outcome of the advisory votes on Resolutions 6, 7, 8 and 8.9.

13. What are our Board's recommendations on how I should vote my shares?

Our Board recommends that you vote your shares as follows: |

| |

Resolutions 1a.-1k.Resolution 1a.-1f. | FOR each of the ordinary resolutions to re-elect the six Directors of the Company.Company named in the section headed “Resolution 1” of this proxy statement. |

Resolution 22a.-2e. | FOR each of the conditional ordinary resolutions to re-elect, if the Rowan Transaction is not completed before the Meeting, the five Directors of the Company named in the section headed “Resolution 2” of this proxy statement. |

| Resolution 3a.-3e. | FOR each of the conditional ordinary resolutions to elect, if the Rowan Transaction is completed before the Meeting, as Directors of the Company the five individuals named in the section headed “Resolution 3” of this proxy statement. |

| Resolution 4 | FOR the ordinary resolution to ratify the Audit Committee's appointment of KPMG LLP (U.S.) as our U.S. independent registered public accounting firm for the year ending 31 December 2018.2019. |

Resolution 35 | FOR the ordinary resolution to appoint KPMG LLP (U.K.) as our U.K. statutory auditors under the U.K. Companies Act 2006. |

Resolution 46 | FOR the ordinary resolution to authorise the Audit Committee to determine our U.K. statutory auditors' remuneration. |

Resolution 5 | FOR the ordinary resolution to approve the Ensco plc 2018 Long-Term Incentive Plan.

|

Resolution 67 | FOR the non-binding advisory vote to approve the Directors' Remuneration Report for the year ended 31 December 2017.2018.

|

Resolution 78 | FOR the non-binding advisory vote to approve the compensation of our named executive officers.

|

Resolution 89 | FOR the non-binding advisory vote to approve the reports of the auditors and the directors and the U.K. statutory accounts for the year ended 31 December 2017.

|

Resolution 9 | FOR the ordinary resolution to approve the share repurchase program.2018.

|

| Resolution 10 | FOR the ordinary resolution to authorise the Board to allot shares.

|

| Resolution 11 | FOR the special resolution to approve the general disapplication of pre-emption rights. |

| Resolution 12 | FOR the special resolution to approve the disapplication of pre-emption rights in connection with an acquisition or specified capital investment. |

All of the nominees named in Resolutions 1a.-1f., 2a.-2e., and 3a.-3e. have indicated that they will be willing and able to serve as directors. If any nominee becomes unwilling or unable to serve as a director, the Board may propose another person in place of that nominee, and the individuals designated as your proxies will vote to elect that proposed person. Alternatively, the Board may decide, as appropriate, to reduce the number of directors constituting the full Board.

14. Are there any other matters to be acted upon at the Meeting?

We do not know of any other matters to be presented or acted upon at the Meeting. If any matters not set forth in the Meeting notice included in the proxy materials are properly brought before the Meeting, the persons named in the accompanying proxy will have discretionary authority to vote on them in accordance with their best judgement.

15. Who is entitled to vote at the Meeting?

You are entitled to vote if you owned shares as of the close of business on the record date, 2625 March 2018.2019. If you are a beneficial owner of Company shares, you must have a legal proxy from the shareholder of record to vote your shares at the Meeting. Each share is entitled to one vote, and there is no cumulative voting.

As of 2625 March 2018,2019, we had 437,273,819437,388,656 shares outstanding. Governing laws as well as our governance documents require our Board to establish a record date in order to determine who is entitled to receive notice of, attend and vote at the Meeting and any continuations, adjournments or postponements thereof. In accordance with the Company's Articles of Association, voting on all resolutions will be conducted on a poll and not on a show of hands.

16. What is the quorum required to hold the Meeting? What are the effects of abstentions and broker non-votes at the Meeting?

For purposes of the Meeting, shareholders present in person or by proxy who represent at least a majority of shares entitled to vote at the Meeting will constitute a quorum. Abstentions and shares held by a broker or its nominee that are voted on any matter are included in determining the number of votes present or represented at the Meeting and are counted for quorum purposes.

An abstention occurs when a shareholder abstains from voting (either in person or by proxy) on one or more of the proposals. Broker non-votes occur whenon resolutions considered by the NYSE to be "non-routine" because a broker bank, trust or other nominee returns a proxy but does not have authority to vote on such resolutions on behalf of a particular proposal.beneficial owner who has not submitted a voting instruction form. In determining the number of votes cast for the Resolutions in this proxy statement, broker non-votes do not count as votes cast, and therefore have no effect on vote outcomes. Abstentions count as votes cast only for Resolution 5, which requires stockholder approval under New York Stock Exchange ("NYSE") rules. For Resolution 5, an abstention has the practical effect of a vote against the Resolution. For all other Resolutions, abstentions do not count as votes cast, and therefore do not affect the vote outcome.

17. How do I vote?

Shareholders of Record: If you are a shareholder of record, you may vote your shares in person at the Meeting or appoint another person as your proxy to exercise any or all of your rights to attend and to speak and vote at the Meeting. You may appoint more than one proxy in relation to the Meeting (provided that each proxy is appointed to exercise the rights attached to a different share or shares held by you). Such proxy need not be a shareholder of record.

To be valid, any proxy card or other instrument appointing a proxy must be received (completed, dated and signed) before 3:00 p.m. Eastern Time on 1817 May 20182019 (the "share voting cutoff time") by mail to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 or by submission via the Internet by going to www.proxyvote.com and following the instructions provided.

Please sign the proxy card exactly as your name appears on the card. If shares are owned jointly, each joint owner should sign the proxy card. If a shareholder is a corporation, limited liability company or partnership, the proxy card should be signed in the full corporate, limited liability company or partnership name by a duly authorised person. If the proxy card is signed pursuant to a power of attorney or by an executor, administrator, trustee or guardian, please state the signatory's full title and provide a certificate or other proof of appointment.

The return of a completed proxy card will not prevent a shareholder from attending and voting at the Meeting.

Beneficial Owners: If you are a beneficial owner, your broker, bank, trust or other nominee will arrange to provide materials and instructions for voting your shares. If you wish to attend the Meeting, you will need to bring evidence of your share ownership in the form of a recently-dated letter from your broker, bank, trust or other nominee and a photo ID as proof of your identity. Upon verification of such evidence, you will be admitted to the Meeting at the invitation of the Chairman. In order to vote at the Meeting, you must obtain a legal proxy from your broker, bank, trust or other shareholder of record and present it to the inspectors of election with your ballot. Please note that you may not vote shares held in street name by returning a proxy card or voting instruction card directly to the Company or by voting at the Meeting unless you provide a legal proxy.

Employees: If you are a current or former Ensco employee who holds shares in the Ensco Savings Plan, you will receive voting instructions from the trustee of the plan for shares allocated to your account. If you fail to give voting instructions to the trustee, your shares will be voted by the trustee in the same proportion and direction as shares held by the trustee for which voting instructions were received. To allow sufficient time for voting by the trustee and administrator of the Ensco Savings Plan, your voting instructions for shares held in the plan must be received by 11:59 p.m. Eastern Time on 1514 May 20182019.

18. What can I do if I change my mind after I vote?

Shareholders of Record: If you are a shareholder of record, you may revoke your proxy or otherwise change your vote by doing one of the following:

sending a written notice of revocation to our secretary at the registered office and headquarters of the Company, which must be received before the share voting cutoff time, 3:00 p.m. Eastern Time on 1817 May 20182019, stating that you would like to revoke your proxy;

by completing, signing and dating another proxy card and returning it by mail to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 in time to be received before the share voting cutoff time, in which case your later-submitted proxy will be recorded and your earlier proxy revoked;

if you voted electronically, by returning to www.proxyvote.com and changing your vote before the share voting cutoff time. Follow the same voting process, and your original vote will be superseded; or

by attending the Meeting and voting in person, though simply attending the Meeting without voting will not revoke your proxy or change your vote.

Beneficial Owners: If you are a beneficial owner, you can revoke your voting instructions or otherwise change your vote by following the instructions provided by your broker or other nominee before the applicable deadline. You may also vote in person at the Meeting if you obtain a legal proxy as described in the answer to Question 17.

19. What if I do not specify a choice for a resolution in my proxy?

If you sign and return your proxy card appointing the persons designated by the Board as your proxies without indicating how you want your shares to be voted, your shares will be voted FOR the resolutions or otherwise in accordance with our Board's recommendations by the persons designated as your proxies in Question 1.

20. Will my shares be voted if I do not provide my proxy or instruction form?

If you are a shareholder of record and do not provide a proxy, you must attend the Meeting in order to vote. If you are a beneficial owner and hold shares through an account with a bank or broker, your shares may be voted if you do not provide voting instructions. Brokerage firms have the authority under the NYSE rules to vote shares for which their customers do not provide voting instructions on routine matters. When a matter is not routine and the brokerage firm has not received voting instructions from the beneficial owner, the brokerage firm cannot vote the shares on that matter. This is called a broker non-vote. For example, the ratification of the selection of independent auditors is considered a routine matter, and the brokerage firm can vote for or against this resolution at its discretion, but the election of directors is not considered routine for these purposes.

21. What does it mean if I receive more than one Notice?

If you received multiple Notices, it means that you hold your shares in different ways (trust, custodial accounts, joint tenancy) or in multiple accounts. Each Notice you receive should be voted.

22. Who will pay for the cost of this proxy solicitation?

We will bear the cost of this proxy solicitation. In addition to solicitation by mail, some of our directors, officers and employees may solicit proxies in person or by telephone for no additional compensation. We will also ask shareholders of record who are brokerage firms, custodians and fiduciaries to forward proxy materials to the beneficial owners of such shares and upon request we will reimburse such shareholders of record for the customary costs of forwarding the proxy materials. We have retained D.F. King & Co., Inc. ("D.F. King") to assist in the solicitation of proxies and anticipate that this will cost us approximately $15,000plus certain out-of-pocket expenses.

23. Who will count the votes?

Broadridge Financial Solutions, Inc. will count the votes submitted by proxy and submit themprovide such report to our inspectors of election. The inspectors of election will be present at the Meeting.

24. When will Ensco announce the voting results?

We will report the final results in a Current Report on Form 8-K filed with the SEC shortly after the Meeting.

| |

| 25. | Does Ensco have a policy about Directors' attendance at the Meeting? |

It is our policy that directors should attend annual general meetings of shareholders barring extenuating circumstances. All incumbent directors attended the 20172018 Annual General Meeting of Shareholders, except Jack E. Golden and Phil D. Wedemeyer, who were both appointed as directors after the 2017 Annual General Meeting.Shareholders.

26. What can I do if I have audit concerns?

Under Section 527 of the Companies Act, shareholders meeting the threshold requirements set out in that section have the right to require the Company to publish on a website a statement setting out any matter relating to: (i) the audit of the Company's accounts (including the auditor's report and the conduct of the audit) that are to be laid before the Meeting; or (ii) any circumstance connected with an auditor of the Company ceasing to hold office since the previous meeting at which annual accounts and reports were laid in accordance with Section 437 of the Companies Act. The Company may not require the shareholders requesting any such website publication to pay its expenses in complying with Section 527 of the Companies Act. Where the Company is required to place a statement on a website under Section 527 of the Companies Act, it must forward the statement to the Company's auditor not later than the time when it makes the statement available on the website. The business that may be dealt with at the Meeting includes any statement that the Company has been required to publish on a website under Section 527 of the Companies Act.

27. Who should I contact if I have additional questions?

If you have any further questions about voting or attending the Meeting, please contact our proxy solicitor, D.F. King. Shareholders may call toll-free at 1-866-342-2676,1-800-461-9313, and banks and brokers may call collect at 1-212-269-5550. D.F. King may be reached by email at ensco@dfking.com.

Shareholders who have general queries about the Meeting also can call Ensco at 1-713-789-1400 and ask for the Investor Relations department. No other methods of communication will be accepted. You may not use any electronic address provided either in this proxy statement or any related documents (including the proxy materials) to communicate with the Company for any purposes other than those expressly stated.

OWNERSHIP OF VOTING SECURITIES

The following tables show amounts and percentages of our Class A ordinary shares (the only class of our securities outstanding and eligible to vote) owned beneficially as of 15 March 20182019 by (i) each person or group known by us to beneficially own more than 5% of our outstanding shares; (ii) each of our directors;directors and each director nominee as of the date of this proxy statement; (iii) each of our named executive officers identified in the 20172018 Summary Compensation Table (the "Named Executive Officers" or "NEOs"); and (iv) all of our current directors and executive officers as a group.group as at the date of this proxy statement.

Beneficial Ownership Table

| | | | Beneficial Ownership(1) | | Beneficial Ownership(1) | |

| Name of Beneficial Owner | Amount | | | Percentage | | Amount | | | Percentage | |

| Capital International Investors | | 48,216,697 |

| (2) | | 11.02 | % | |

| 11100 Santa Monica Boulevard, 16th Floor | | | | | |

| Los Angeles, California 90025 | | | | | |

| The Vanguard Group | | 39,859,158 |

| (3) | | 9.11 | % | |

| 100 Vanguard Blvd. | | | | | |

| Malvern, Pennsylvania 19355 | | | | | |

| BlackRock, Inc. | 48,257,622 |

| (2) | | 11.10 | % | | 30,509,788 |

| (4) | | 6.98 | % | |

| 55 East 52nd Street | | | | | | | | |

| New York, New York 10022 | | | | | | | | |

| The Vanguard Group | 37,417,813 |

| (3) | | 8.58 | % | | |

| 100 Vanguard Blvd. | | | | | |

| Malvern, Pennsylvania 19355 | | | | | |

| Capital International Investors | 35,569,664 |

| (4) | | 8.10 | % | | |

| 11100 Santa Monica Boulevard, 16th Floor | | | | | |

| Los Angeles, California 90025 | | | | | |

| FMR LLC | 35,095,104 |

| (5) | | 7.98 | % | | 30,183,106 |

| (5) | | 6.90 | % | |

| 245 Summer Street | | | | | | | | |

| Boston, Massachusetts 02210 | | | | | | | | |

| Named Executive Officers: | | | | | |

| Dimensional Fund Advisors LP | | 29,624,460 |

| (6) | | 6.77 | % | |

| Building One | | | | | |

| 6300 Bee Cave Road | | | | | |

| Austin, Texas 78746 | | | | | |

| Named Executive Officers | | | | | |

| Carl G. Trowell | 1,061,666 |

| | — | % | (6) | 1,026,153 |

| | — | % | (7) |

| President and Chief Executive Officer, Director | | | | | | | | |

| Jonathan Baksht | 86,370 |

| | | — | % | (6) | |

| Senior Vice President and Chief Financial Officer | | | | | |

P. Carey Lowe (2) | 560,185 |

| | | — | % | (6) | |

| P. Carey Lowe | | 540,711 |

| | | — | % | (7) |

| Executive Vice President and Chief Operating Officer | | | | | | | | |

| Steven J. Brady | 319,364 |

| | — | % | (6) | 271,238 |

| | — | % | (7) |

| Senior Vice President—Eastern Hemisphere | | | | | | | | |

| Gilles Luca | 333,914 |

| | — | % | (6) | 312,807 |

| | — | % | (7) |

| Senior Vice President—Western Hemisphere | | | | | | | | |

| Independent Directors | | | | | |

| J. Roderick Clark | 41,029 |

| | | — | % | (6) | |

| Jonathan Baksht | | 125,878 |

| | | — | % | (7) |

| Senior Vice President and Chief Financial Officer | | | | | |

| Independent Directors as of 15 March 2019 | | | |

| |

| Paul E. Rowsey, III | | 88,354 |

| | — | % | (7) |

| Director, Non-Executive Chairman of the Board | | | | | |

| Jack E. Golden | | 82,632 |

| | — | % | (7) |

| Director | | | | | | | | |

| Roxanne J. Decyk | 21,393 |

| | — | % | (6) | |

| Director | | | | | |

| Mary E. Francis CBE | 11,847 |

| | — | % | (6) | |

| Director | | | | | |

| C. Christopher Gaut | 44,715 |

| | | — | % | (6) | |

| Director | | | | | |

| Jack E. Golden | 77,500 |

| | — | % | (6) | |

| Phil D. Wedemeyer | | 76,553 |

| | — | % | (7) |

| Director | | | | | | | | |

| Gerald W. Haddock | 48,412 |

| | — | % | (6) | 69,432 |

| | — | % | (7) |

| Director | | | | | | | | |

| Francis S. Kalman | 43,399 |

| | | — | % | (6) | 62,253 |

| | | — | % | (7) |

| Director | | | | | | | | |

| C. Christopher Gaut | | 58,314 |

| | | — | % | (7) |

| Director | | | | | |

| J. Roderick Clark | | 54,628 |

| | | — | % | (7) |

| Director | | | | | |

| Keith O. Rattie | 36,860 |

| | | — | % | (6) | 48,357 |

| | | — | % | (7) |

| Director | | | | | | | | |

| Paul E. Rowsey, III | 62,670 |

| | — | % | (6) | |

| Director, Non-Executive Chairman of the Board | | | | | |

| Phil D. Wedemeyer | 71,023 |

| | — | % | (6) | |

| Director | | | | | |

All current directors and executive officers as a group (17 persons) (7) | 3,152,082 |

| | | — | % | (6) | |

|

| | | | | | | |

| Roxanne J. Decyk | 34,992 |

| | | — | % | (7) |

| Director | | | | | |

| Mary E. Francis CBE | 23,406 |

| | | — | % | (7) |

| Director | | | | | |

All current directors and executive officers as a group (17 persons) (8) | 3,269,212 |

| | | — | % | (7) |

| Rowan Nominees | | | | | |

Dr. Thomas Burke(8) | — |

| | | — | % | (7) |

| Nominee Director | | | | | |

William E. Albrecht(8) | — |

| | | — | % | (7) |

| Nominee Director | | | | | |

Suzanne P. Nimocks(8) | — |

|

| | — | % | (7) |

| Nominee Director | | | | | |

Thierry Pilenko(8) | — |

| | | — | % | (7) |

| Nominee Director | | | | | |

Charles L. Szews(8) | — |

| | | — | % | (7) |

| Nominee Director | | | | | |

____________________

| |

(1) | As of 15 March 2018,2019, there were 437,273,819437,388,656 shares outstanding. Unless otherwise indicated, each person or group has sole voting and dispositive power with respect to all shares. |

| |

(2) | Based on the Schedule 13G/A filed on 814 February 2018, BlackRock, Inc.2019, Capital International Investors ("BlackRock"Capital") may be deemed to be the beneficial owner of 48,257,62248,216,697 shares. BlackRockCapital reports sole voting power over 46,948,97444,060,082 shares and sole dispositive power over 48,257,62248,216,697 shares. |

| |

(3) | Based on the Schedule 13G/A filed on 811 February 2018,2019, The Vanguard Group ("Vanguard") may be deemed to be the beneficial owner of 37,417,81339,859,158 shares. Vanguard reports sole voting power over 470,942129,083 shares, shared voting power over 99,404104,604 shares, sole dispositive power over 36,882,59439,667,683 shares and shared dispositive power over 535,219191,475 shares. |

| |

(4) | Based on the Schedule 13G/A filed on 144 February 2018, Capital International Investors2019, BlackRock, Inc. ("Capital"BlackRock") may be deemed to be the beneficial ownersowner of 35,569,66430,509,788 shares. CapitalBlackRock reports sole voting power over 31,907,69930,210,611 shares and sole dispositive power over 35,569,66430,509,788 shares. |

| |

(5) | Based on the Schedule 13G13G/A filed on 13 February 2018,2019, FMR, LLC ("FMR") may be deemed to be the beneficial owner of 35,095,10430,183,106 shares. FMR reports sole voting power over 5,215,9684,925,409 shares and sole dispositive power over 35,095,10430,183,106 shares. |

| |

(6) | Based on the Schedule 13G filed on 8 February 2019, Dimensional Fund Advisors LP ("Dimensional") may be deemed to be the beneficial owner of 29,624,460 shares. Dimensional reports sole voting power over 28,970,860 shares and sole dispositive power over 29,624,460 shares. |

| |

(7) | Ownership is less than 1% of our shares outstanding. |

| |

(7)(8)

| The numberElection conditional on completion of shares beneficially owned by all current directors and executive officers as a group includes 7,839 shares that may be acquired within 60 days of 15 March 2018 by exercise of stock options.the Rowan Transaction |

RESOLUTIONS 1a. - 1k.1f.

| |

| 1. | ORDINARY RESOLUTIONS TO RE-ELECT EACH OF THE FOLLOWING DIRECTORS: |

1a. J. RODERICK CLARK

1b. ROXANNE J. DECYK

1c. MARY E. FRANCIS CBE

1d.1c. C. CHRISTOPHER GAUT

1e. JACK E. GOLDEN

1f. GERALD W. HADDOCK

1g. FRANCIS S. KALMAN

1h.1d. KEITH O. RATTIE

1i.1e. PAUL E. ROWSEY, III

1j.1f. CARL G. TROWELL

1k. PHIL D. WEDEMEYER

AS DIRECTORS OF THE COMPANY FOR A TERM TO EXPIRE AT THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD IN 2019.2020.

Each of the above Board nominees is an incumbent director of the Company. Under the terms of the Transaction Agreement entered into between the Company and Rowan Companies plc ("Rowan"), dated as of October 7, 2018 (as amended and as may be further amended from time to time) (the "Transaction Agreement") pursuant to which we have agreed to acquire the entire issued and to be issued Class A ordinary share capital of Rowan (the "Rowan Transaction"), we have agreed with Rowan that each of the above Board nominees shall, following closing of the Rowan Transaction, serve on the board of the combined entity (subject to, among other things, annual re-election by shareholders). The Rowan Transaction has beennot yet closed but is expected to close prior to the Meeting. Accordingly, in view of the agreement reached with Rowan regarding the composition of the Board of the combined entity, whether or not the Rowan Transaction has closed prior to the Meeting, each of the above Board nominees is nominated by our Board for re-election at the Meeting.

We have majority voting for the election of directors. A nominee seeking election will be elected if a simple majority of the votes cast are cast in favour of the resolution to elect the director nominee. In determining the number of votes cast, shares that abstain from voting or are not voted will not be treated as votes cast. Each director nominee will be considered separately. You may cast your vote for or against each nominee or abstain from voting your shares in connection with one or more of the nominees.

The Board recommends that shareholders vote FOR each nominee standing for election as director.

If no indication is given as to how you want your shares to be voted, the persons designated as proxies will vote the proxies received FOR each nominee.

Nominees

J. Roderick Clark; age 67;68; Former President and Chief Operating Officer of Baker Hughes Incorporated (Retired)

Mr. Clark has been one of our directors since 2008. He served as President and Chief Operating Officer of Baker Hughes Incorporated from 2004 through January 2008. Before becoming President and Chief Operating Officer, he served as Vice President, Marketing and Technology. Mr. Clark joined Baker Hughes Incorporated during 2001 as President of Baker Petrolite. He formerly served as President and Chief Executive Officer of Consolidated Equipment Companies Inc. He also formerly served as President of Sperry-Sun, a Halliburton company. Mr. Clark has also previously held financial, operational and leadership positions with FMC Corporation, Schlumberger and Grace Energy Corporation. Mr. Clark serves as a director and a business consultant/advisor for Sammons Enterprises, Inc. He is the Chairman of the Board of Trustees of the Dallas Theological Seminary and also serves as a trustee of the Dallas Theological Seminary.trustee. He holds Bachelor of Arts and Master of Business Administration degrees from the University of Texas. Mr. Clark currently serves as Chairman of our Compensation Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Clark should serve as a director include his 3233 years of experience in the oilfield services industry serving global markets, his drilling industry experience, his service as an executive officer of a Fortune 500 company, his corporate governance, compliance and risk management experience and his board and audit committee service for a public company engaged in tanker shipping operations.

Roxanne J. Decyk; age 65; Former Executive Vice President of Global Government Relations for Royal Dutch Shell plc (Retired)

Ms. Decyk has been one of our directors since 2013. She retired as Executive Vice President of Global Government Relations for Royal Dutch Shell plc, a global oil and gas company, in December 2010, after serving in that position since 2009. From 2008 until 2009, Ms. Decyk served as Corporate Affairs and Sustainable Development Director of Royal Dutch Shell plc, from 2005 to 2009, she served on the Executive Committee and from 2005 to 2008, she also served as Corporate Affairs Director. Prior thereto, Ms. Decyk was Senior Vice President - Corporate Affairs and Human Resources of Shell Oil Company and Vice President of Corporate Strategy of Shell International Limited. She has served as a director of Orbital ATK (formerly Alliant Techsystems Inc.) since 2010 and a director of Weatherford International plc since September 2017. She was previously a director of Petrofac Limited from 2011 until May 2015, Snap-on Incorporated from 1993 until June 2014 and Digital Globe from 2014 to 2017. She earned a Bachelor of Arts degree from the University of Illinois at Urbana-Champaign in English literature and a Juris Doctorate from Marquette University Law School. Ms. Decyk currently serves on our Compensation Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Ms. Decyk should serve as a director include her experience in various executive leadership positions for international, integrated energy companies, significant strategy experience, knowledge of the demands and expectations of our core customers, significant experience in human resources and particularly executive compensation, experience as a board member for public companies and expertise in global government affairs.

Mary E. Francis CBE; age 69;70; Former Senior Civil Servant in British Treasury and Prime Minister's Office (Retired)

Ms. Francis has been one of our directors since 2013. She is a former senior civil servant in the British Treasury and the Prime Minister's office and was subsequently Director General of the Association of British Insurers. Since 2013, Ms. Francis has beenserved as a non-executive director of the Swiss Re Group, having been appointed to the Board of Directors of Swiss Reinsurance Company Ltd. in October 2012. Ms. Francis is expected to retireretired from the boardboards of Swiss Re Group and Swiss Reinsurance Company Ltd. in April 2018. Ms. Francis was appointed to the Boards of Directors of Barclays PLC and Barclays Bank PLC in October 2016. She served on the Board of Directors of Centrica plc, an integrated energy company, between 2004 and 2014, and was Senior Independent Director from 2006. From 2005 to 2012, she served as a non-executive director of Aviva plc, and from 2009 to 2012, she served as a non-executive director of Cable & Wireless Communications Plc. She is also a former non-executive director of the Bank of England, Alliance & Leicester plc and St. Modwen Properties PLC and is a Senior Adviser to the International Relations Institute, Chatham House. She earned a Master of Arts in History from Newnham College, University of Cambridge. Ms. Francis currently serves on our Audit Committee and our Nominating and Governance Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Ms. Francis should serve as a director include her experience as a director for various British and international public companies, experience as the chairman of board committees for several public companies, expertise in matters of corporate governance, and experience in senior positions within the U.K. government.

C. Christopher Gaut; age 61;62; Chief Executive Officer and Chairman of Forum Energy Technologies, Inc.

Mr. Gaut has been one of our directors since 2008. He ishas been the President and Chief Executive Officer and Chairman of Forum Energy Technologies, Inc., a publicly traded global provider of manufactured equipment and products to the energy industry.industry, since November 2018, a position he also held from August 2010 until May 2017. He previously served as Executive Chairman of Forum Energy Technologies, Inc. from May 2017 to December 2017 and as Chairman and Chief Executive Officer from August 2010 to May 2017.November 2018. Mr. Gaut previously served as a Managing Director of SCF Partners, a Houston, Texas based private equity firm that engages in investment and acquisition of energy service companies. Prior to joining SCF Partners, he served as President of Halliburton Company's Drilling and Evaluation Division from January 2008 until April 2009. Mr. Gaut also previously served from February 2003 until December 2007 as Executive Vice President and Chief Financial Officer of Halliburton Company, one of the world's largest providers of products and services to the energy industry. He was appointed tohas served on the board of directors of EOG Resources, Inc., a leading exploration and production company, since October 2017, and previously served on the board of directors of Key Energy Services in December 2016 and EOG Resources, Inc. in October 2017.Services. Mr. Gaut holds a Bachelor of Arts degree in Engineering Sciences from Dartmouth College and a Master of Business Administration from the Wharton School of Business at the University of Pennsylvania. Mr. Gaut currently serves on our Nominating and Governance Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Gaut should serve as a director include his vast experience in the drilling and oilfield services industries, having served in executive

positions with, and on the board of directors of, several companies in the energy service sector, and his strong background in finance, operations and investments in the global energy sector.

Jack E. Golden; age 69; Managing Director of Edgewater Energy LLC

Mr. Golden became a director in October 2017 in connection with our acquisition of Atwood Oceanics, Inc. where he served as a director since 2009. Mr. Golden is managing partner of Edgewater Energy LLC, a Texas-based oil and gas company. Previously, Mr. Golden was employed by BP p.l.c. from 1982 through his retirement in 2005, where he served in various executive capacities including Group Vice President - Exploration and Production. As Group Vice President - Exploration and Production, he directed significant portions of BP's global exploration and production operations. Mr. Golden also serves as a director of Cobalt International Energy, Inc., a publicly-traded independent exploration and production company. He also serves as a director of two private companies, Sand Hill Petroleum and Edgemarc Energy. Mr. Golden has a Bachelor of Science and a Master of Science in Physics from Texas A&M University and a PhD in Physics from Kansas State University.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Golden should serve as a director include his vast years of public company oil and gas exploration and production company management experience and his extensive experience serving on other boards of directors.

Gerald W. Haddock; age 70; President and Founder of Haddock Enterprises, LLC

Mr. Haddock has been one of our directors since 1986. In 2000, he founded Haddock Enterprises, LLC, an entrepreneurial development company concentrating in private investments and transactions, including oil and gas and real estate, located in Fort Worth, Texas, and has served as its President since that time. Mr. Haddock formerly served as President and Chief Operating Officer of Crescent Real Estate Equities Company from 1994 to 1996 and as President and Chief Executive Officer of Crescent Real Estate Equities Company from 1996 to 1999. During 2005, Mr. Haddock joined the Board of Directors of Meritage Homes Corporation. In addition, he was named Chairman of its Nominating and Corporate Governance Committee during 2006 and was appointed to its Audit Committee in 2009. In November 2017, Mr. Haddock joined the Board of Directors of Union Acquisition Corp., a special purpose acquisition corporation. Mr. Haddock holds Bachelor of Business Administration and Juris Doctorate degrees from Baylor University. He also received a Master of Laws in Taxation degree from New York University and a Master of Business Administration degree from Dallas Baptist University. Mr. Haddock currently serves on our Audit Committee and our Nominating and Governance Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Haddock should serve as a director include his experience and expertise in financial, business and legal matters with significant involvement in corporate governance, financial and tax matters, his knowledge and expertise in international tax and business activities, his service as a Chief Executive Officer and President of a publicly-traded real estate company and his extensive service on our Board and on other public company boards, including service on audit, executive compensation, nominating and corporate governance committees.

Francis S. Kalman; age 70; Former Executive Vice President of McDermott International, Inc. (Retired)

Mr. Kalman became a director in 2011 in connection with our acquisition of Pride International, Inc., where he served as a director since 2005. Mr. Kalman served as Executive Vice President of McDermott International, Inc. from 2002 until his retirement in 2008 and as Chief Financial Officer from 2002 until 2007. From 2000 to 2002, he was Senior Vice President and Chief Financial Officer of Vector ESP, Inc., from 1999 to 2000, he was a principal of Pinnacle Equity Partners, LLC, from 1998 to 1999, he was Executive Vice President and Chief Financial Officer of Chemical Logistics Corporation and from 1996 to 1997, he was Senior Vice President and Chief Financial Officer of Keystone International, Inc. Mr. Kalman currently serves as a senior advisor to a private investment subsidiary of Tudor, Pickering, Holt & Co., LLC, which specialises in direct investments in upstream, midstream and oilfield service companies. He also serves on the Board of Directors, the Audit Committee and the Nominating and Governance Committee of Weatherford International plc. Mr. Kalman was previously a principal of Ancora Partners, LLC, a private equity group, which was liquidated in 2014. Mr. Kalman holds a Bachelor of Science degree in Accounting from Long Island University. Mr. Kalman currently serves on our Audit Committee and our Compensation Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Kalman should serve as a director include experience in executive leadership and strategic planning for various international energy service companies, experience in accounting, auditing and financial reporting for global organisations and financial expertise generally in the oil and gas industry.

Keith O. Rattie; age 64;65; Former Chairman, President and Chief Executive Officer of Questar Corporation and Former Chairman of QEP Resources (Retired)

Mr. Rattie has been one of our directors since 2008. Mr. Rattie previously served as President of Questar Corporation, a natural gas focused energy company, from February 2001 until July 2010, Chief Executive Officer from May 2002 until July 2010 and Chairman from May 2003 until July 2010. He previously served as Non-Executive Chairman of Questar from July 2010 to July 2012. Mr. Rattie continued to serve as a director of Questar until May 2014. He previously served as Non-Executive Chairman of QEP Resources from July 2010 to July 2012. He previously served as Vice President and Senior Vice President of Coastal Corporation, a diversified energy company. Prior to joining Coastal Corporation, he spent 19 years with Chevron Corporation in various engineering and management positions, including as General Manager of Chevron's international gas unit. He serves as a director of Select Energy Services, Inc., a NYSE-listed oilfield services company. Mr. Rattiecompany, where he chairs the Nominating and Governance Committee, and also serves on the Audit Committee of Select Energy Services, Inc.Committee. Mr. Rattie previously served on the board of EP Energy, an independent oil and gas exploration and production company with operations in the U.S. Mr. Rattie is a former chairman of the Board of the Interstate Natural Gas Association of America. He holds a Bachelor of Science degree in Electrical Engineering from the University of Washington and a Master of Business Administration degree from St. Mary's College. Mr. Rattie currently serves as Chairman of our Audit Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Rattie should serve as a director include his extensive background and experience in the energy industry, his prior and current engineering and management positions, his experience as a chief executive officer in general and with respect to management, stewardship, investor and stakeholder relationships in particular and his knowledge of global equity markets.

Paul E. Rowsey, III; age; 63;age 64; Former Chief Executive Officer of Compatriot Capital, Inc. (Retired)

Mr. Rowsey was appointed Non-Executive Chairman of our Board in 2015, and has served as a director since 2000. In September 2017, he retired as the President and Chief Executive Officer of Compatriot Capital, Inc., a real estate investment and operating company, where he was employed since 2011. Prior to joining Compatriot, he was a founder and the managing partner of E2M Partners, LLC, a sponsor and manager of private real estate equity funds and an affiliate of Compatriot. He serves as a member of the Board of Directors of Powdr Corporation, one of the largest alpine skiing and outdoor sports companies in the United States, based in Park City, Utah,Utah; KDC Holdings, a national real estate investment and development firm based in Dallas, Texas, andTexas; JLB Partners, LLC, a multi-family housing development firm and its affiliate, Longbrook Capital Partners, LLC, based in Dallas, Texas; and Invesco Real Estate Income Trust, Inc., a real estate investment company based in Dallas, Texas. Mr. Rowsey is a 1977 magna cum laude graduate of Duke University with a degree in management science and a 1980 cum laude graduate of Southern Methodist University School of Law. Mr. Rowsey also serves as the Chairman of our Nominating and Governance Committee.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Rowsey should serve as a director include his expertise in financial, business and legal matters, his extensive negotiating experience in complex business transactions and his general business acumen.

Carl G. Trowell; age 49;50; President and Chief Executive Officer of the Company

Mr. Trowell joined Ensco in June 2014 as President and Chief Executive Officer.Officer of the Company. He is also a member of the Board. Prior to joining Ensco, Mr. Trowell was President of Schlumberger Integrated Project Management (IPM) and Schlumberger Production Management (SPM) businesses that provide complex oil and gas project solutions ranging from field management, well construction, production and intervention services to well abandonment and rig management. He was promoted to this role after serving as President - Schlumberger WesternGeco Ltd. where he managed more than 6,500 employees with operations in 55 countries. Mr. Trowell began his professional career as a petroleum engineer with Shell before joining Schlumberger where he held a variety of international management positions including Geomarket Manager for North Sea operations and Global Vice President of Marketing and Sales. He has a strong background in the development and deployment of new technologies and has been a member of several industry advisory boards in this capacity. Mr. Trowell is on the advisory board of Energy Ventures, a venture capital company investing in oil and gas technology. In August 2016, Mr. Trowell became a non-executive director of Ophir Energy plc. Mr. Trowell has a PhD in Earth Sciences from the University of Cambridge, a Master of Business

Administration from The Open University and a Bachelor Science degree in Geology from Imperial College London. Mr. Trowell will serve as the Executive Chairman of the Company upon completion of the Rowan Transaction.

The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Trowell should serve as a director include his international experience and perspective, his extensive experience in executive leadership and strategic planning for international companies in the global oil and gas industry, his engineering and management positions, and his strong background in the development and deployment of new technologies.

Resolutions 2a. - 2e.

2. ORDINARY RESOLUTIONS TO RE-ELECT EACH OF THE FOLLOWING DIRECTORS:

2a.ROXANNE J. DECYK

2b.JACK E. GOLDEN

2c.GERALD W. HADDOCK

2d.FRANCIS S. KALMAN

2e.PHIL D. WEDEMEYER

AS DIRECTORS OF THE COMPANY FOR A TERM TO EXPIRE AT THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD IN 2020 PROVIDED THAT, IN EACH CASE, THE ELECTION SHALL BE EFFECTIVE ONLY IF THE COMPANY HAS NOT COMPLETED THE ROWAN TRANSACTION BEFORE THE MEETING.

Each of the above Board nominees is an incumbent director of the Company. Under the terms of the Transaction Agreement which provides for the Rowan Transaction, we have agreed with Rowan that each of the above Board nominees shall not serve on the board of the combined entity following closing of the Rowan Transaction, and each of the nominees has agreed to resign from the Board effective as of the closing. The Rowan Transaction has not yet closed but is expected to close prior to the Meeting. Accordingly, in view of the agreement reached with Rowan regarding the composition of the Board of the combined entity, each of the above Board nominees is nominated by our Board for re-election at the Meeting, such election to be effective only if the Company has not completed the Rowan Transaction before the Meeting.

We have majority voting for the election of directors. A nominee seeking election will be elected if a simple majority of the votes cast are cast in favour of the resolution to elect the director nominee. In determining the number of votes cast, shares that abstain from voting or are not voted will not be treated as votes cast. Each director nominee will be considered separately. You may cast your vote for or against each nominee or abstain from voting your shares in connection with one or more of the nominees.

The Board recommends that shareholders vote FOR each nominee standing for election as director.

If no indication is given as to how you want your shares to be voted, the persons designated as proxies will vote the proxies received FOR each nominee.

Nominees

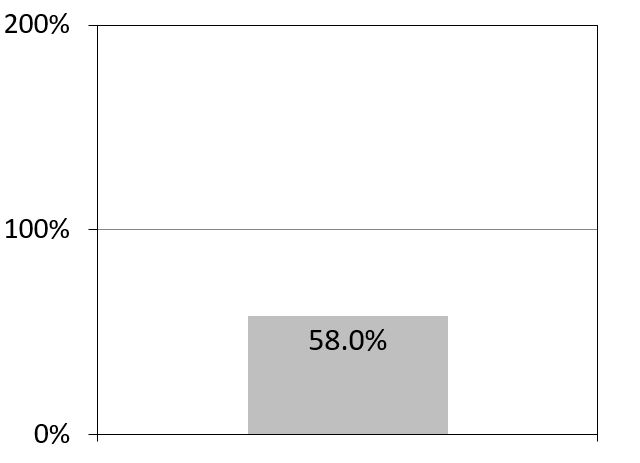

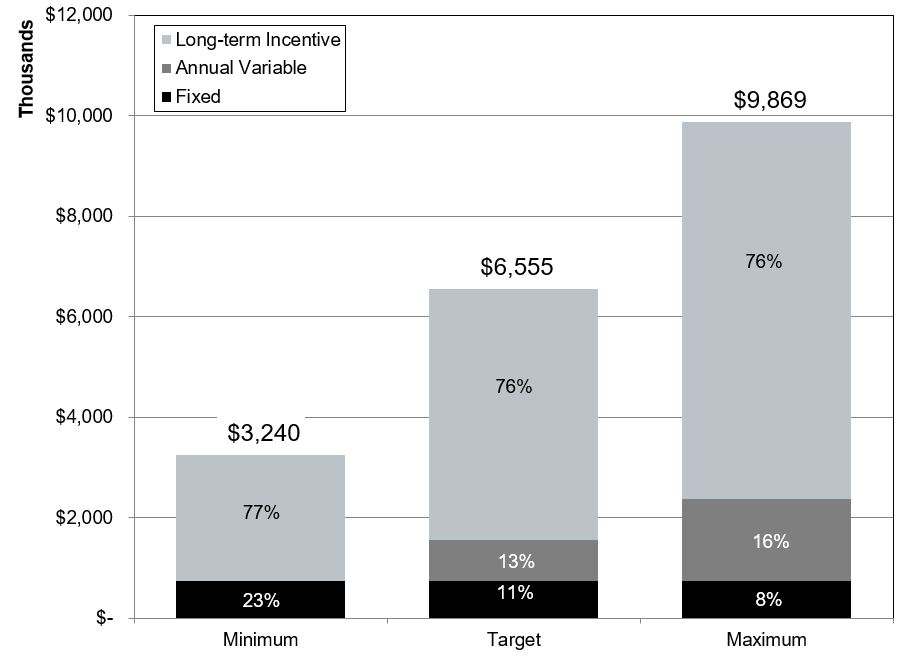

Roxanne J. Decyk; age 66; Former Executive Vice President of Global Government Relations for Royal Dutch Shell plc (Retired)